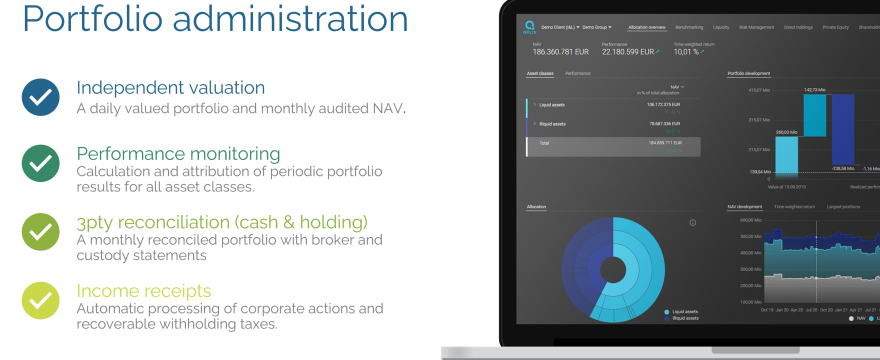

Portfolio Administration

Our portfolio administration service is designed to align with your strategic portfolio structure, ensuring seamless and consolidated reporting across all asset classes. Key features of our service include:

- Flexible design of portfolio and fund structures

- Processing all trade and non-trade related cash movements

- Monitoring and processing of capital transactions

- Monitoring and recording of corporate actions

- Reviewing and reconciling broker/custody agents statements

- Independently value the fund’s portfolio using agreed upon pricing policy

- Calculating daily, weekly, monthly or quarterly net asset value as required

- Direct engagement with your portfolio administrator

Financial administration

The financial administration and general ledger journals are maintained on the basis of the agreed general ledger account structure and valuation and accounting policies. Our focus is to provide you with the required information for the annual financial statements including any financial explanatory paragraphs and risk sections. The important features of our services are:

- Maintaining books and records in accordance with fund governing documents

- Collating and documenting all underlying investment information

- Preparing financial statements in accordance with relevant accounting standards

- Preparation of NAV package including trial balance, balance sheet and statements of operations

- Provision of supporting documentation of all trial balance line items

- Draft financial statements including explanatory paragraphs

- Necessary concentration risk sections based on look-through portfolio data

- Assisting auditors with annual audit

Our aim is to provide you with an integrated, transparent, and efficient service, ensuring that you have all the necessary information for annual financial statements, including detailed financial explanations and risk assessments.